travel nursing tax home audit

The second biggest challenge for travel nurses when it comes to taxes is establishing and maintaining a tax home. Home NJ Newark Accounting Services Certified Public Accountants.

How To Sail Through An Irs Audit A Guide For Travel Nurses Totalmed

But if youre following step 2 you should be good to go.

. 455 Hoes Lane Piscataway NJ 08854 Phone. The mean daily cost for nursing home care in New Jersey is about 300 with costs ranging between 159 and 401 per day. You will also need to pay estimated taxes since there are no tax withholdings for.

Travel nurses can experience tax audits at a higher rate than other positions because of the high rate of nontaxable income compared to taxable income. As we began our last piece on nursing taxes. Take your pay as taxable for local travel nursing jobs If youre working locally and can drive home between shifts Barth recommends taking the salary as taxable income.

Some audits are completely random so there is really no way to predict or avoid them. Mar 03 2021. In addition to patient care skills a good bedside manner and medical knowledge travel nurses also need to be well.

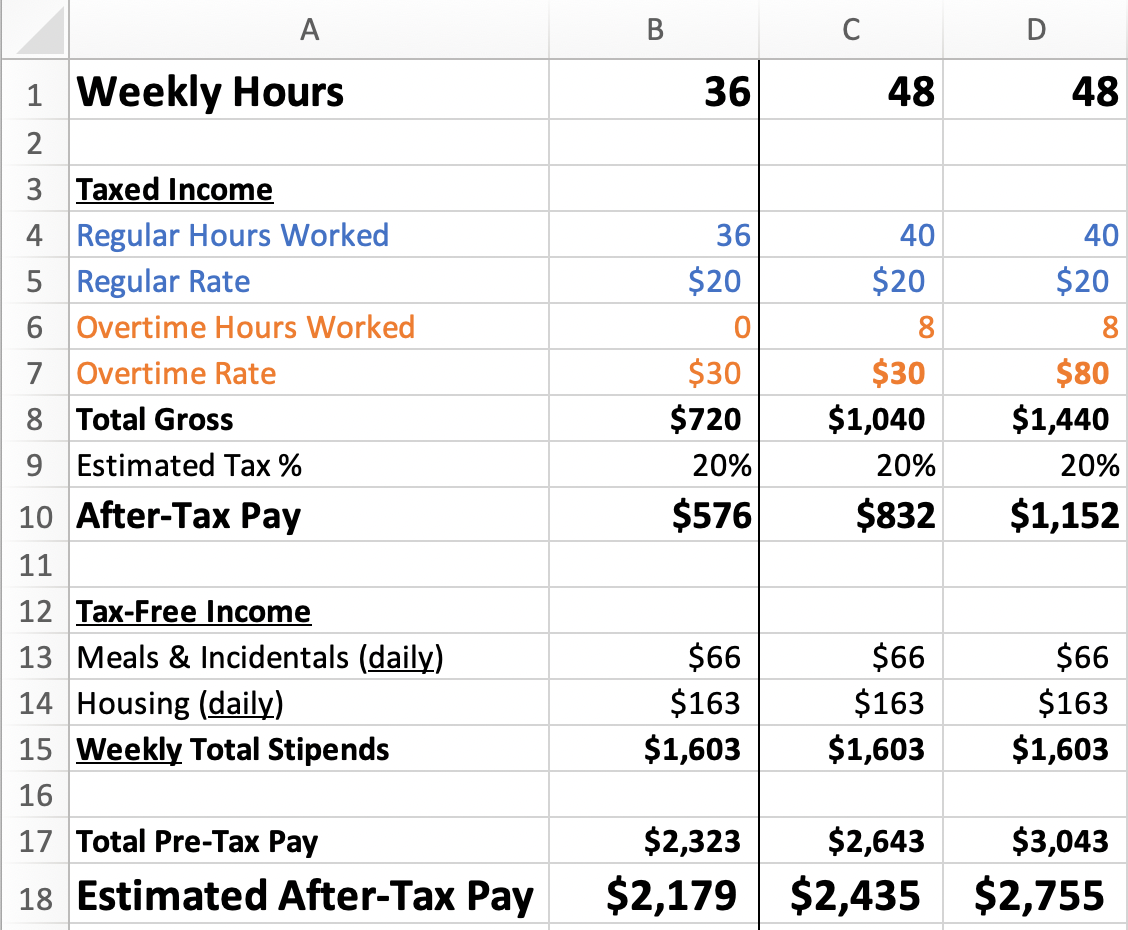

Deciphering the travel nursing pay structure and tax rules can be complicated. And then there are travel nurse taxes. So as a Travel Nurse it can get kind of confusing where yours is right.

While working as a travel nurse adds. A home energy audit is the systematic review of the interior and exterior of your home to determine its energy use and the potential for savings and efficiency. US tax home clients.

This is not always the. Name A - Z Sponsored Links. A certified Jersey City.

Travel nurses must have a tax home. After paying the fee below please call us to schedule. This includes airfare driving your car and other modes of transportation.

Audit Firm in Newark NJ. Jan 29 2021. Joseph Smith is an IRS Enrolled Agent and former travel respiratory therapist whose firm TravelTax LLC provides tax preparation and audit representation for the mobile professional.

There are 19 nursing homes near Springfield New Jersey. InternationalCanadian tax home clients. Dont File Your Taxes Until You Read This.

But there are some pretty standard guidelines out there for travel nurses that we can follow to stay safer in case of an audit. Travel Nursing Tax Home Audit. Tax homes tax-free stipends hourly wages bonuses benefits housing and per.

After paying fee below schedule your tax home consult via online scheduler. A tax home is different than a home home. As we began our last.

Travel nurse taxes are due on April 15th just like other individual income tax returns.

Understanding Tax Home Requirements In Traveling Nursing And Avoiding Irs Audits Nurse Cheung Youtube

Understanding Travel Nurse Taxes Guide 2022

Talking Travel Nurse Taxes The 50 Mile Rule The Gypsy Nurse

Critical Documents For Tax Audits

Previous Traveler Faqs Page Travel Nurse Tax Prep Healthcare Traveler Cross Border Tax Prep

Understanding Travel Nurse Taxes Guide 2022

4 Must Know Rules To Tax Free Money As A Travel Nurse Nomadicare

Top 10 Myths And Fibs In Travel Nursing Bluepipes Blog

Being Audited By The Irs You Have A Few Options Forbes Advisor

Travel Nurse And Allied Tax Homes Tax Free Traveltax And I Talk About It All It S Amazing Youtube

Travel Nurse Taxes What Are Tax Homes Trusted Health

Top 10 Myths And Fibs In Travel Nursing Bluepipes Blog

Travel Nurse Tax Guide 2022 Travel Nursing

Travel Nursing A Guide A Guide For New Travel Nurses Arranged By David I Mancini Rn Do No Harm Medium

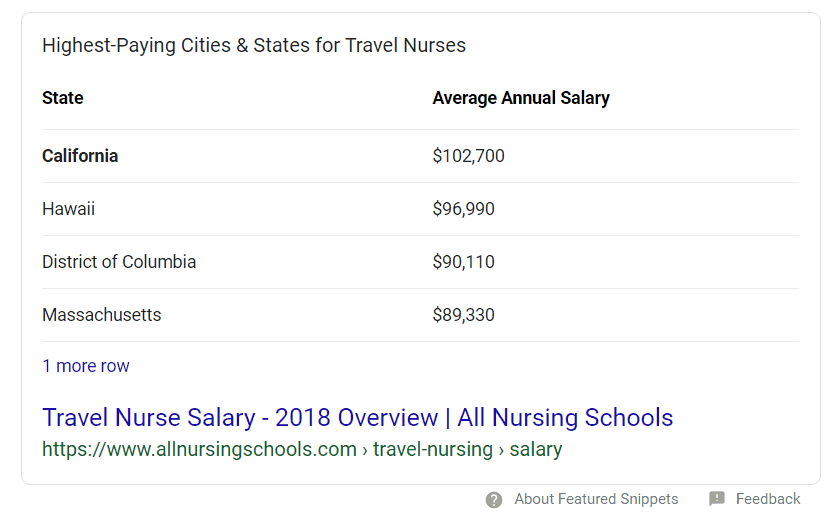

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

How Low Should You Go Understanding Taxable Travel Nurse Pay